I like to start the new year with a stocktake of how my finances are doing and whether my savings and investments went according to plan, then using this as a prelude to setting some plans and goals for the coming year. This isn’t the only focus for the year, so check out future posts to find out more about setting intentions, vision boards and the like. But it is a good way of gathering some baseline data to see where I am starting from.

To say 2022 was a tricky year financially is a massive understatement. Whilst the economy globally seemed to be strengthening post-COVID at the start of the year, the invasion of Ukraine in February turned a lot of the world’s certainties on their head. Prices started to go up for petrol, food, energy, leading to massive cost increases in the basics for most households.

This trend has continued throughout the year, with supply chain issues as well as scarcity in some areas leading to a crisis with the soaring cost of living. I feel like I’ve been writing about this all year: 92% of adults in the UK have reported an increase in the cost of living, with 60% saying they are ‘very concerned’ about their ability to cope with additional rises. Food banks in the UK had to distribute more than 1.3 million food parcels in 2022, an increase of 50% since pre-COVID figures. I recognise that whilst financial freedom remains a critical goal in my life, so many people are getting closer to the financial precipice that they really need to get support, and get it now.

Inflation also grew at a significant and rapid rate, hitting almost 11% in the UK by the end of December. For many people, including me, this had an immediate impact on mortgage interest rates, biting even deeper into the daily costs of getting by. Whilst the expectation is that inflation has now hit its highest point and will start to reduce in 2023, the impact (and uncertainty) of these shifts are real.

It has also been a shaky year for the markets. Again an understatement, with the Financial Times headline for the end of the year reading Stock and bond markets shed more than $30tn in ‘brutal’ 2022. Markets in the US had their worst year since 2008 (and we all remember what a brilliant year that was). Whilst I love FIRE and the focus on both balancing for risks, and keeping your head in the event of a downturn – and I have definitely moved on from panic selling in 2020 – it has felt like another rollercoaster ride which just hasn’t been that fun.

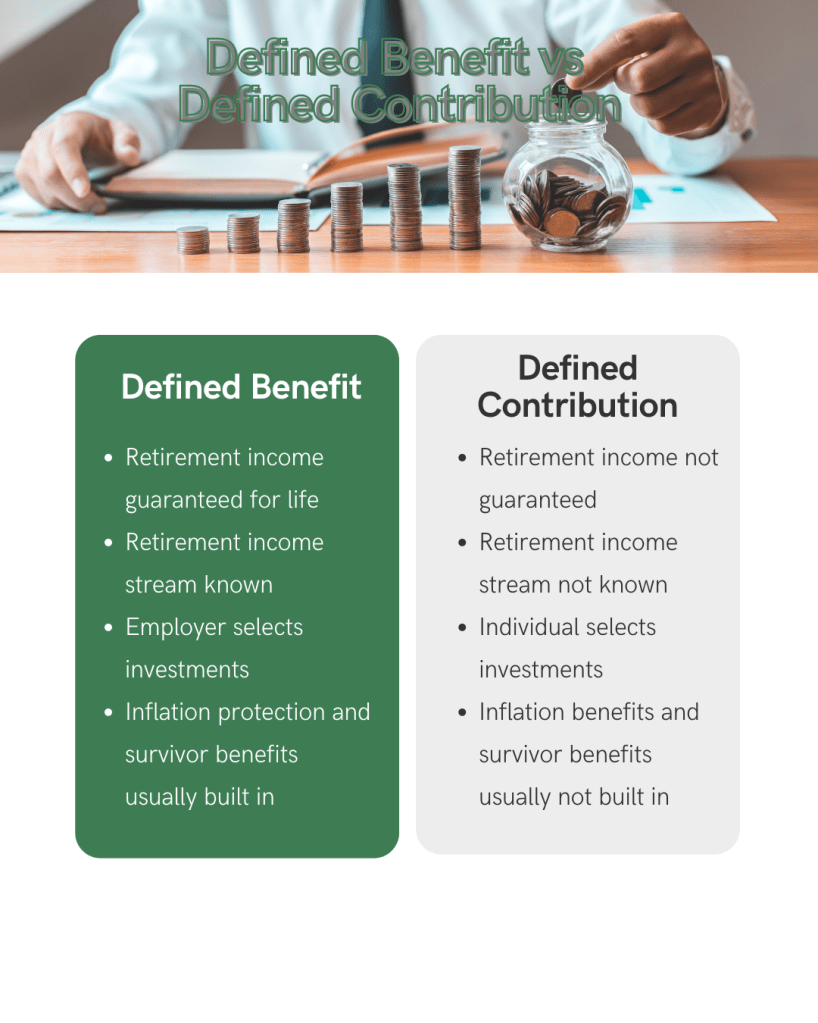

This has also been the worst year in terms of growth for my own portfolio. I made some major changes this year (more about this in future posts) to rebalance away from being over-invested in property, but continued to invest throughout the year in mutual funds and my pensions. I added in kids’ savings here which I don’t normally do, but as they are starting to get older I need to come back to my financial planning for them, and make sure I am adjusting as needed depending on their age and stage.

My investments this year came to almost £80,000, though some of this came from my property sale meaning that my investment from salary alone came to £50,000. I am extremely proud of this figure and what it represents in terms of prioritisation and tenacity. Since I have been working on myself over the last few years, I can feel that pride at the same time as recognising that my salary and privileges mean that I am in a very unusual and blessed position.

| 2022 Contributions | |

| Personal pension (SIPP) | £ 8,600 |

| Savings (stocks and shares ISA, emergency savings) | £ 31,000 |

| Work Pension (pre-tax) | £ 18,444 |

| Mortgage capital overpaid | £ 5,000 |

| Kids’ savings (JISA, J-SIPP) | £ 16,000 |

| Contributions | £ 79,044 |

Next steps for me are to do a review of my net worth (and realistically to not compare it to a US$ amount as I traditionally have – with the recent forex issues, this is a pathway to sadness) and set out some plans and goals for 2023. Whilst I do that, I will just continue to save and invest as usual, and get ready for what is hopefully an easier year for us all.

Look forward to hearing about your 2022 and how able you were to follow your financial plans given that major challenges during the year.