So I think a lot about pensions. Pensions are by far the biggest topic when I talk to women in the same sector as I am. Or single parents. Or anyone who has moved between jobs, or between traditional jobs and entrepreneurship. So, everyone really.

There are a few different schools of thought. Many younger people I speak to have such little faith in the pensions industry that they are not convinced of the need to invest in retirement vehicles. In fact one-third of savers don’t have faith in the industry – and this survey was done with savers, so imagine the additional people who don’t have faith to the point where they just don’t save. Almost 60% of people believe they will not have enough to retire on, with women being significantly less confident about their ability to retire at all, or comfortably.

I’ve written a couple of times about calculating what you need to retire on, and on working out across your own financial journeys, especially if you want to retire early, where you might have gaps in your income prior to being able to access pension funds.

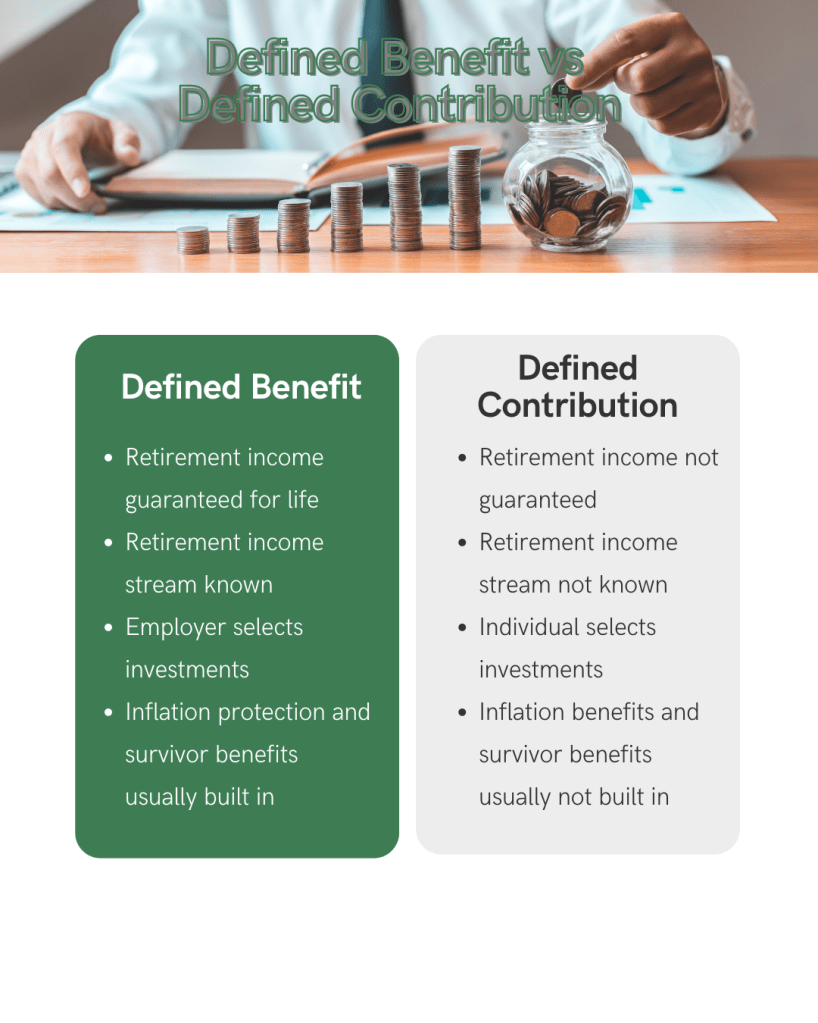

One tricky area to work through is the difference between defined benefit and defined contribution pensions. Sometimes I imagine myself on the Dave Ramsey show explaining at length why I don’t have $1million in retirement, and why that doesn’t matter because I am largely in defined benefit pensions. I realise that we have now plumbed the depths of my boring internal monologue, but putting that aside, let’s continue.

The first point is that defined benefit pensions are largely in the public sector, and they are increasingly rare. The second is that you will very rarely be able to choose which one you get. You may, if you are joining public service, be offered this option. And – whislt I don’t normally give unequivocal advice – you should always choose defined benefits for the reasons outlined below:

Defined benefit pensions are usually linked to the length of service in the company, so it can feel pretty small or silly, but it all adds up. The greatest benefit to defined contribution is that a) you can choose where to invest the funds yourself and b) you can usually roll pension contributions into a single fund as you move jobs.

I have three defined benefit pensions, and one SIPP which I invest into regardless of how good my company pension looks. The figures below assume I stay in my current job for another two years: many defined benefit pensions require a minimum stay with the organisation. So how do my pensions look?

| Transfer value | Annual guaranteed income retirement | |

| Defined benefit pension 1 | £ 62,304 | £ 6,250 |

| Defined benefit pension 2 | £ 39,462 | £ 1,400 |

| Defined benefit pension 3 | £ 104,864 | £ 15,266 |

| £ 206,630 | £ 22,916 | |

| Self Invested Personal Pension (SIPP) | £ 44,075 | £ 400 |

| TOTAL ACROSS ALL | £ 250,705 | £ 23,316 |

Even a quick glance suggests that the benefit from the defined pension is better than the defined contribution on the SIPP. However – and it’s a significant caveat – the SIPP will grow with the market. Or hopefully grow, in these days, who knows.

This is where it gets interesting. Using the more traditional FIRE rule of 4% withdrawal, to achieve the £30,000 per year in retirement I would need to save £750,000 overall. Side bar – Mustachian Calcs are great calculators for working this sort of thing out. As you can see, I am not far off from that £30,000, and indeed would reach it if I could add in the UK State Pension (caveats galore!) but my portfolio ‘value’ is only around one-third of that net worth calculation.

Definitely more on this in blogs to come. It’s both a tangled old web, and a cornerstone of what we’re trying to do here. So do come back and join me on Instagram for more.